A Touch-Optimized UI Framework.

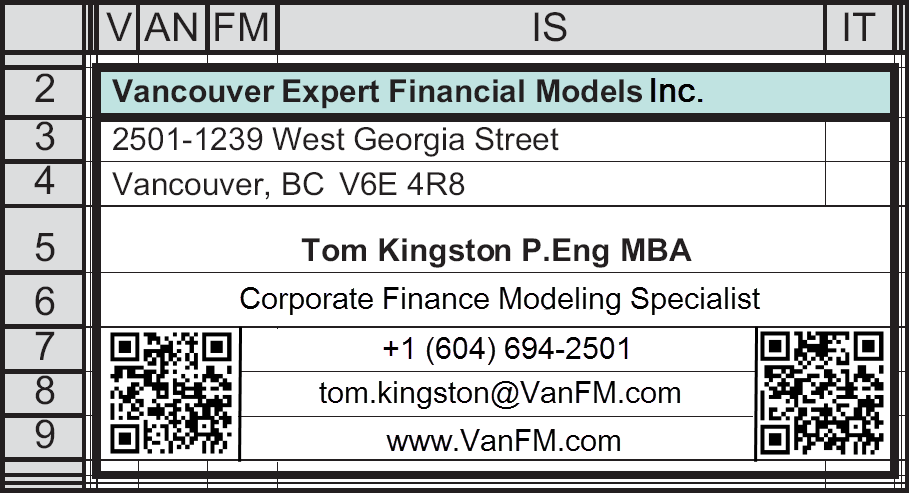

Vancouver Expert Financial Models Inc.

An updated report, Apr 14 2019, for Western Copper and Gold is available here

N.B. The reports below are more than six years old. Keep in mind much has changed for many of these companies. Updated reports for each of these companies can be made available on a fixed fee or hourly rate basis.

Western Copper and Gold (WRN)

Valuation

Jun 09 2015 closing price - CAD 0.55/share, model price at IPO USD at IPO USD 4.56/share using a 12% discount rate and USD 2.75 Copper/pound.The Good

1.1 billion tonnes of ore to be mined; 14.55% Unlevered after tax IRR; politically stable region, no major permitting issues. USD 3.00 Copper Price per pound would result in a share price of USD 7.74/share (no Metal Streams); very good grades of secondary minerals, 0.247g/t Au, 1.803 g/t Ag, 0.020% Mo, CuEq grade 0.465%.The Bad

Lower grade copper deposit, 0.180% average Cu grade of ore to be mined, this is offset by very good grades of secondary minerals; no infrastructure in place, will have to build own power plant, etc.The Bottom Line

Very good mining jurisdiction - Yukon, CANADA; Cu Equivalent grade - 0.50% per WRN May 2015 Corp presentation. The low Cu grade is offset by very good grades of secondary minerals. BIG MINE, median daily ore throughput 149,000 t/d (Heap Leach - 25,000t/d, Concentrator 124,000t/d). The 14.55% Unlevered after tax IRR is the second highest of the six projects that have not been acquired (Augusta and Lumina acquired).Candente Copper (DNT)

Valuation

Jun 09 2015 closing price - CAD 0.09/share, model price at IPO USD 1.41/share using a 15% discount rate and USD 2.75 Copper/pound. (see Assumptions on front page of Candente Copper Financial Model PDF).The Good

17.27% Unlevered after tax IRR at USD 2.75 Copper/pound (includes a USD 2B construction cost per S. Waller in Nov 2012, and a T Kingston estimate of a 20% increase in mining, processing, and G&A Costs from the March 2011 AMEC Pre-Feasibility Progress Report); 0.40% average Cu grade of ore mined, 728 million tonnes of ore to be mined (i.e. BIG deposit); 70% of local population support project, strong central government support; upside potential from Canariaco Sur and Quebrada Verde not included in this analysis (increased mine life and/or ore mixing benefits).The Bad

Arsenic in ore; Northern Peru - Anti-Mining Activists are active in the local area - they spread a lot of fear among the local population and investors; Limited fire damage to forest and a few small buildings was incurred by radicals in Dec 2012; Company will have to raise funds to complete feasibility study. The company has very limited cash resources.The Bottom Line

You have to be satisfied that the rule of law will prevail in Peru and that the central government and local population do indeed support and will continue to support the project. Further you have to be satisfied that arsenic in the final concentrate can be reduced to non-penalty levels by roasting or other means; Very good IRR.Nevada Copper (NCU)

Valuation

Jun 09 2015 closing price CAD 1.72/share, model price at IPO USD 1.56/share using a 12% discount rate and USD 2.75 Copper/pound; The construction and operating costs used in this analysis were taken from the Feb 03 2012 Feasibility Study. A new integrated feasibility study is scheduled for release in July 2015.The Good

0.53% average Cu grade of ore mined (open pit and underground), 365 million tonnes of ore to be mined; politically stable region, no major permitting issues. 14.29% Unlevered after tax IRR (at USD 2.75 Copper/pound) using the Feb 03 2012 Feasibility Study. USD 3.00 Copper Price per pound would result in a share price of USD 4.89/share(no Metal Streams). Good candidate for Streaming at Copper pricing above USD 3.00.The Bad

Although the new Integrated Feasibility Study has not been released yet, the May 28 2015 news release states that only a 15.5% Unlevered after tax IRR is achieved when prices of USD 3.15 copper per pound, USD 1,200 gold per ounce and USD 18 silver per ounce are used.The Bottom Line

Although the new Integrated Feasibility Study has not been released yet, I had hoped for a higher Unlevered after tax IRR when using prices of USD 3.15 copper per pound, USD 1,200 gold per ounce and USD 18 silver per ounce. When the feasibility study is released, I will be updating the Nevada Copper model, although it will be not be publically available.Yellowhead Mining (YMI)

Valuation

Jun 09 2015 closing price CAD 0.09/share, model price at IPO USD 0.96/share using a 12% discount rate and USD 2.75 Copper/pound.The Good

716 million tonnes of ore to be mined; excellent infrastructure already in place or nearby; politically stable region, no major permitting issues. USD 3.00 Copper Price per pound would result in a share price of USD 2.64/share (no Metal Streams). Excellent candidate for Streaming at Copper pricing above USD 3.00.The Bad

only a 11.59% Unlevered after tax IRR at USD 2.75 Copper/pound; lower grade deposit, 0.258% average Cu grade of ore to be mined, average tonne of ore milled has pay revenue of only USD 14.19 based on USD 2.75Cu, USD 1200Au and USD 20.00Ag;The Bottom Line

Project requires a high copper price to be economic.Catalyst Copper (CCY)

Valuation

Jun 09 2015 closing price CAD 0.195/share, model price at IPO USD 0.00/share using a 12% discount rate and USD 2.75 Copper/pound (i.e. the project cannot generate a 12% return to IPO shareholders using USD 2.75 per pound Copper).The Good

588 million tonnes of ore to be mined; 0.37% average Cu grade of ore mined; politically stable region, no major permitting issues. Major capital structure restructuring (share consolidation) and New Management in 2014. USD 3.00 Copper Price per pound would result in a share price of USD 1.37/share (no Metal Streams).The Bad

only an 11.08% Unlevered after tax IRR at USD 2.75 Copper/pound; high mining costs and processing costs, USD 5.80 and USD 6.17 per tonne milled, respectively; Arsenic in ore.The Bottom Line

Project requires a high copper price to be economic, the highest of the seven projects; high mining costs and processing costs, USD 5.80 and USD 6.17 per tonne milled, respectively.Northern Dynasty (NDM)

Valuation

Jun 09 2015 closing price CAD 0.485/share, model price at IPO USD 3.82/share using a 12% discount rate and USD 2.75 Copper/pound.The Good

3.4 billion tonnes of ore to be mined over 45 years (likely minimum 78 year mine life); 0.45% average Cu grade of ore mined (45 yrs); very high gold in ore for a copper mine - 0.386 grams/tonne Au (45 yrs); politically stable region; NDM owns 100% of the project. Excellent Candidate for Streaming.The Bad

only a 10.95% Unlevered after tax IRR at USD 2.75 Copper/pound; deposit is near one of the world's greatest salmon resources; there are environmental permitting issues; no infrastructure in place, will have to build own power plant, etc.; Anglo American, previously 50% partner, backed out of project recently; offset (the good) is Anglo American already spent USD M 514 on project and NDM now owns 100% of project; high construction cost USD B 5.8; NDM has commercial operation beginning in 2021 - this analysis has commercial operation Jan 2019.The Bottom Line

Huge deposit; Pebble is the World's Largest Undeveloped Copper Resource per NDM - 0.83% Cu Equivalent grade per NDM Sep 2013 Corp presentation. Environmental issues may kill this project.Augusta Resource (AZC)

Valuation

Jan 14 2014 closing price - CAD 1.41/share, model price at IPO USD 4.87/share using a 12% discount rate and USD 2.75 Copper/pound. (Acquired by HudBay Minerals at USD 3.56 per share in June 2014 - Comments from Jan 14 2014 below).The Good

18.43% Unlevered after tax IRR at USD 2.75 Copper/pound; 0.44% average Cu grade of ore mined, 600 million tonnes of ore to be mined (i.e. BIG deposit), politically stable region, sold forward all gold at USD 450/oz and silver at USD 3.90/oz to Silver Wheaton in exchange for USD 230M when material permits are received; project can handle the lowest copper price of the seven companies and still be economic.The Bad

option to buy in 20% of project by a third party (Note: the model price of USD 4.87/share assumes this is exercised); Possible permitting issues (see Nov 20 2013 news release)The Bottom Line

This is likely the safest investment of the seven projects; the project can handle the lowest copper price of the seven companies and still be economic. This project has the highest Unlevered after tax IRR of the seven projects.Lumina Copper (LCC)

Valuation

Jan 14 2014 closing price CAD 6.25/share, model price at IPO USD 19.04/share using a 15% discount rate and USD 2.75 Copper/pound. (Acquired by First Quantum Minerals at USD 10.00 per share in August 2014 - Comments from Jan 14 2014 below).The Good

16.46% Unlevered after tax IRR at USD 2.75 Copper/pound; 1.65 billion tonnes of ore to be mined; 0.46% average Cu grade of ore mined.The Bad

Argentina (high taxes); high percentage of revenue to pay royalties and taxes, the highest of the seven projects.The Bottom Line

Great deposit and project, high taxes and high country risk.- Detailed PDF's of Financial Models - Copper

- EXECUTIVE SUMMARY

- Western Copper and Gold (WRN)

- Candente Copper (DNT)

- Nevada Copper (NCU)

- Yellowhead Mining (YMI)

- Catalyst Copper (CCY)

- Northern Dynasty (NDM)

- Augusta Resource (AZC)

- Lumina Copper (LCC)